HONOLULU (AP) — A federal judge’s ruling has cleared the way for Hawaii to include cruise ship passengers in a new tourist tax to help cope with climate change, a levy set to go into effect at the start of 2026.

U.S. District Judge Jill A. Otake denied a request Tuesday that sought to stop officials from enforcing the new law on cruises.

In the nation’s first such levy to help cope with a warming planet, Hawaii Gov. Josh Green signed legislation in May that raises tax revenue to deal with eroding shorelines, wildfires and other climate problems. Officials estimate the tax will generate nearly $100 million annually.

The levy increases rates on hotel room and vacation rental stays but also imposes a new 11% tax on the gross fares paid by a cruise ship’s passengers, starting next year, prorated for the number of days the vessels are in Hawaii ports.

Cruise Lines International Association challenged the tax in a lawsuit, along with a Honolulu company that provides supplies and provisions to cruise ships and tour businesses out of Kauai and the Big Island that rely on cruise ship passengers. Among their arguments is that the new law violates the Constitution by taxing cruise ships for the privilege of entering Hawaii ports.

Plaintiff lawyers also argued that the tax would hurt tourism by making cruises more expensive. The lawsuit notes the law authorizes counties to collect an additional 3% surcharge, bringing the total to 14% of prorated fares.

“Cruise tourism generates nearly $1 billion in total economic impact for Hawai‘i and supports thousands of local jobs, and we remain focused on ensuring that success continues on a lawful, sustainable foundation,” association spokesperson Jim McCarthy said in a statement.

According to court records, plaintiffs will appeal. They asked the judge to grant an injunction pending an appeal and requested a ruling by Saturday afternoon given the law takes effect Jan. 1.

Hawaii will continue to defend the law, which requires cruise operators to pay their share of transient accommodation tax to address climate change threats to the state, state Attorney General Anne Lopez said in a statement.

The U.S. government intervened in the case, calling the tax a “scheme to extort American citizens and businesses solely to benefit Hawaii” in conflict with federal law.

Department of Justice attorneys are also asking to maintain the status quo for 30 days or until there is an appeals court ruling.

LATEST POSTS

- 1

Easy to understand Tech: Cell phones for Old in 2024

Easy to understand Tech: Cell phones for Old in 2024 - 2

Lily Allen 2026 'West End Girl' Tour: How to get tickets, prices, presale info and more

Lily Allen 2026 'West End Girl' Tour: How to get tickets, prices, presale info and more - 3

James Webb Space Telescope's mysterious 'little red dots' may be black holes in disguise

James Webb Space Telescope's mysterious 'little red dots' may be black holes in disguise - 4

Figure out how to Perceive Warnings while Looking for an Auto Collision Lawyer

Figure out how to Perceive Warnings while Looking for an Auto Collision Lawyer - 5

Find the Wonders of the Silk Street: Following the Antiquated Shipping lanes

Find the Wonders of the Silk Street: Following the Antiquated Shipping lanes

Longtime United Launch Alliance CEO Tory Bruno resigns from space company. 'Finished the mission I came to do.'

Longtime United Launch Alliance CEO Tory Bruno resigns from space company. 'Finished the mission I came to do.' Famous Rough terrain Vehicles for 2024

Famous Rough terrain Vehicles for 2024 US FDA panel to weigh bid to market nicotine pouches as lower-risk than cigarettes

US FDA panel to weigh bid to market nicotine pouches as lower-risk than cigarettes 5 Food varieties to Remember for Your Eating regimen for Ideal Wellbeing

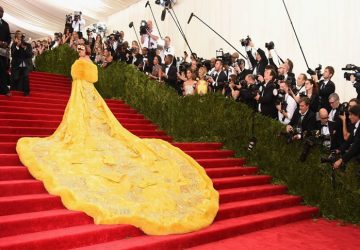

5 Food varieties to Remember for Your Eating regimen for Ideal Wellbeing The 10 Most Famous Style Minutes on Honorary pathway

The 10 Most Famous Style Minutes on Honorary pathway SpaceX launches Starlink satellites on its 150th Falcon 9 mission of the year

SpaceX launches Starlink satellites on its 150th Falcon 9 mission of the year A few Exemplary Chinese Dishes, Which Are Famous Around the world

A few Exemplary Chinese Dishes, Which Are Famous Around the world Kendall Jenner addresses long-standing rumor about her sexuality

Kendall Jenner addresses long-standing rumor about her sexuality Best Disney Palace: Which One Catches Your Creative mind?

Best Disney Palace: Which One Catches Your Creative mind?